UNIT IV; Bank Balance Sheets and the Creation of Money

UNIT IV; Bank Balance Sheets and the Creation of Money

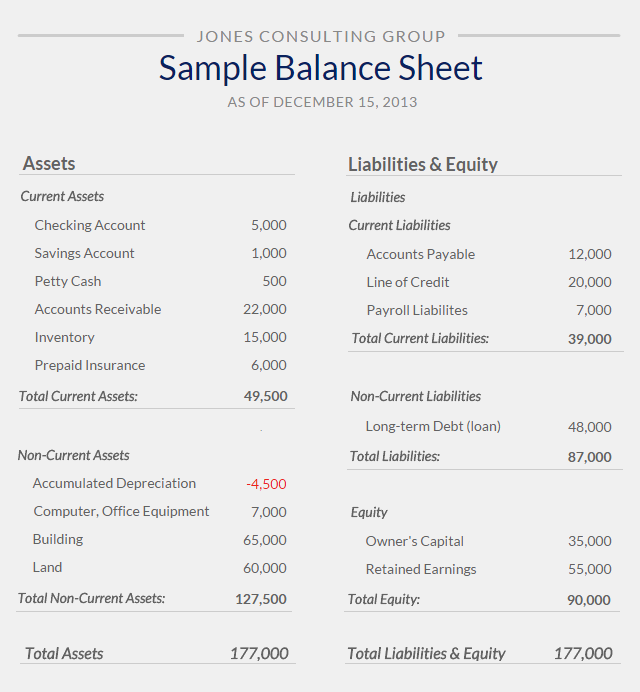

Balance Sheet

-for companies or banks the balance sheet is a t-chart

-summarizes the financial position of the bank at any given time

-LEFT: assets, own

-RIGHT: liabilities, owe

Fractional Reserve Banking System

-the banks have to keep a fraction of the total money supply that is held in reserve as currency

-basically the bank cannot loan out everything that is in the vault

-banks must keep a percent of deposits determined by the fed

RR+ER=DD

Monetary policy

-Feds balance sheet helps us consider how to Fed conducts monetary policy

-Feds assets and liabilities differ from a commercial bank

Fed balance sheet

Banks & the Creation of Money

How do banks "create" money?

through loans

Where do loans come from?

They come from depositors who place cash into their accounts. An example would be if I deposit 200 dollars into my account, and someone else comes for a loan, they will use a fraction of the cash I deposited indirectly without actually effecting my bank account.

How are the amounts of potential loans calculated?

Banks Balance Sheets

Bank liabilities (to the right of the T chart)

1. DD or CD

2. owners equity or net worth

Bank assets (to the left side of the T chart)

1. RR

2. ER

3. bank property

4. securities & bonds

5. loans

Money Creation (using excess reserves)

The Money Multiplier (also known as)

The formula is simple: 1/5the reserve requirement (ratio)

Excess Reserves are multiplied by the Multiplier

Your blog is very neat and organized. However, you are missing a few notes on expansionary and contractionary monetary policies. Remember, expansionary is "easy" money and buy bonds. Contractionary is "tight" money and sell bonds. Make sure to also include description of the shifts for each policy as well.

ReplyDeleteThis is a simple, straightforward post with great images, but I feel adding a bullet exclaiming that assets must equal liabilities and "balance" out the balance sheet would be a good addition to this post.

ReplyDelete